CDSL Share Price Surge in 2024: Navigating the Growth and Potential

In 2024, the stock market has seen its fair share of volatility, but amidst the turbulence, certain stocks have managed to capture the attention of investors with their consistent performance and growth potential. One such stock is Central Depository Services (India) Limited, commonly known as CDSL. As India’s only listed depository, CDSL plays a crucial role in the Indian financial market, and its share price has been a focal point for many investors this year.

The Role of CDSL in India’s Financial Ecosystem

CDSL is a pivotal entity in India’s financial infrastructure. It provides depository services, enabling the holding of securities in electronic form and facilitating transactions in the stock market. In a rapidly digitizing world, the demand for such services has only increased, positioning CDSL as a key player in the Indian financial market. As more investors enter the stock market, the need for reliable and efficient depository services grows, directly impacting CDSL’s business and, consequently, its share price.

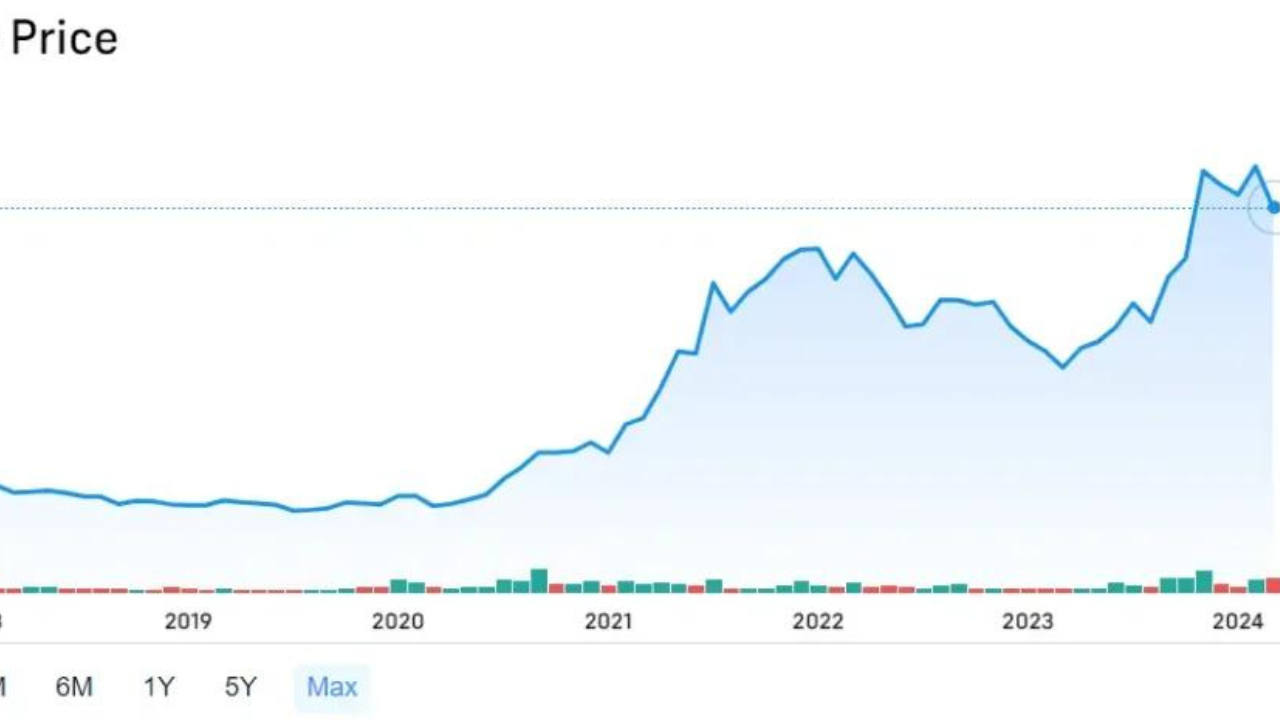

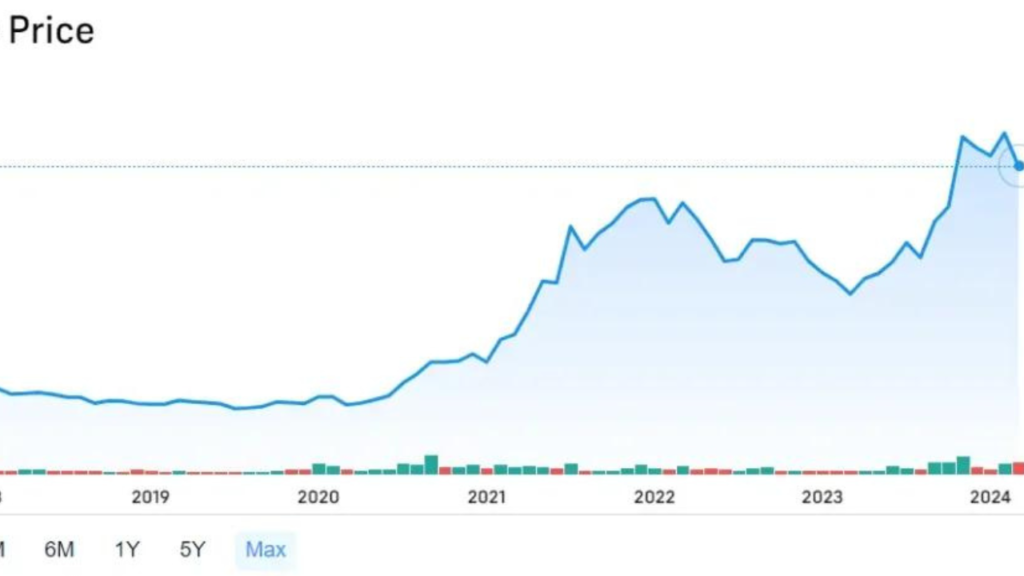

The Share Price Journey in 2024

The year 2024 has been a rollercoaster for many stocks, but CDSL has shown resilience. Starting the year on a strong note, CDSL’s share price has experienced fluctuations in response to market conditions, investor sentiment, and broader economic factors. Despite these ups and downs, the overall trajectory has been one of growth.

One of the significant drivers of CDSL’s share price in 2024 has been the increasing number of demat accounts in India. As more retail investors enter the stock market, the demand for depository services has surged, directly benefiting CDSL. The company’s ability to capitalize on this growing market has been reflected in its share price.

Moreover, CDSL’s focus on innovation and expanding its service offerings has played a crucial role in maintaining investor confidence. By continuously improving its technology infrastructure and introducing new services, CDSL has managed to stay ahead of the curve, further boosting its market position.

Investor Sentiment and Market Outlook

Investor sentiment towards CDSL has remained largely positive throughout 2024. The company’s strong fundamentals, combined with its strategic initiatives, have inspired confidence among investors. Additionally, the broader market trend of increasing participation from retail investors has provided a tailwind for CDSL’s growth.

However, like any stock, CDSL is not immune to market risks. The global economic environment, regulatory changes, and technological disruptions could pose challenges. Investors need to remain vigilant and consider these factors when making investment decisions. Diversification and a long-term perspective are key to navigating potential volatility.

The Road Ahead

Looking ahead, CDSL is well-positioned to continue its growth trajectory. The company’s ability to adapt to changing market dynamics, coupled with its strong market position, makes it a promising candidate for long-term investment. As India continues to embrace digital financial services, the demand for CDSL’s offerings is expected to grow, further enhancing its share price.

For investors, the key takeaway is the importance of understanding the broader market trends and the specific factors driving CDSL’s growth. While the stock has shown resilience in 2024, it is essential to stay informed and make decisions based on thorough research and analysis.

Conclusion

In 2024, CDSL’s share price has been a testament to the company’s robust business model and its critical role in India’s financial ecosystem. As the market evolves, CDSL’s ability to innovate and adapt will be crucial in sustaining its growth. For investors, CDSL represents an opportunity to be part of a company that is not only growing but is also shaping the future of India’s financial market. With the right strategy and a focus on long-term potential, CDSL could be a cornerstone of a successful investment portfolio.